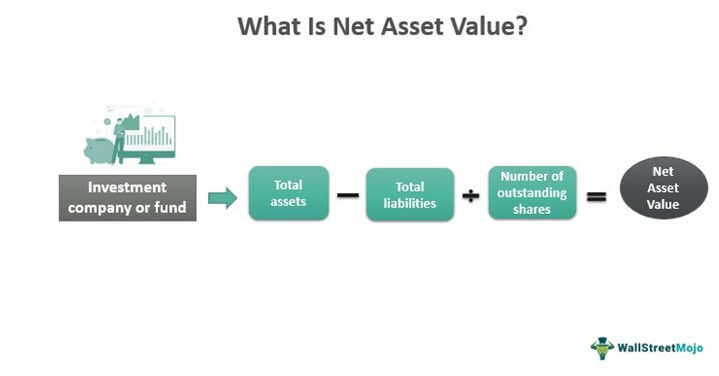

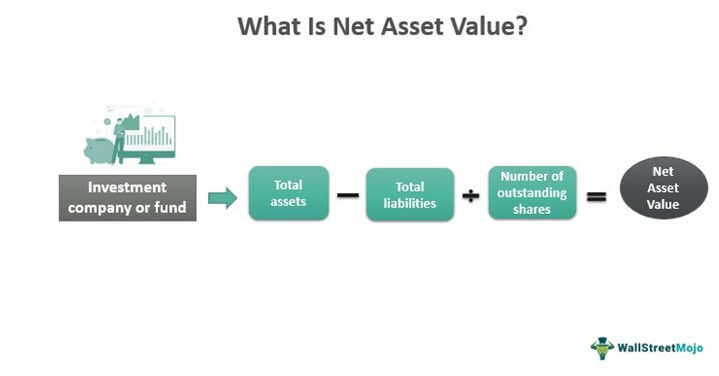

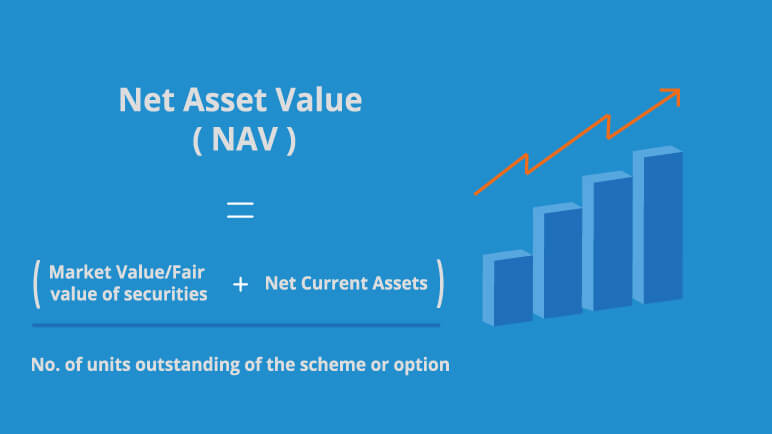

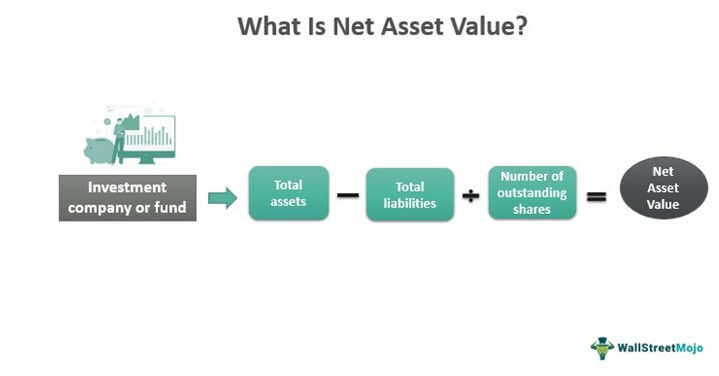

Net asset value. Tangible or intangible assets. Valuing assets. Fixed leg своп формула. Methods of intangible assets valuation.

Net asset value. Tangible or intangible assets. Valuing assets. Fixed leg своп формула. Methods of intangible assets valuation.

|

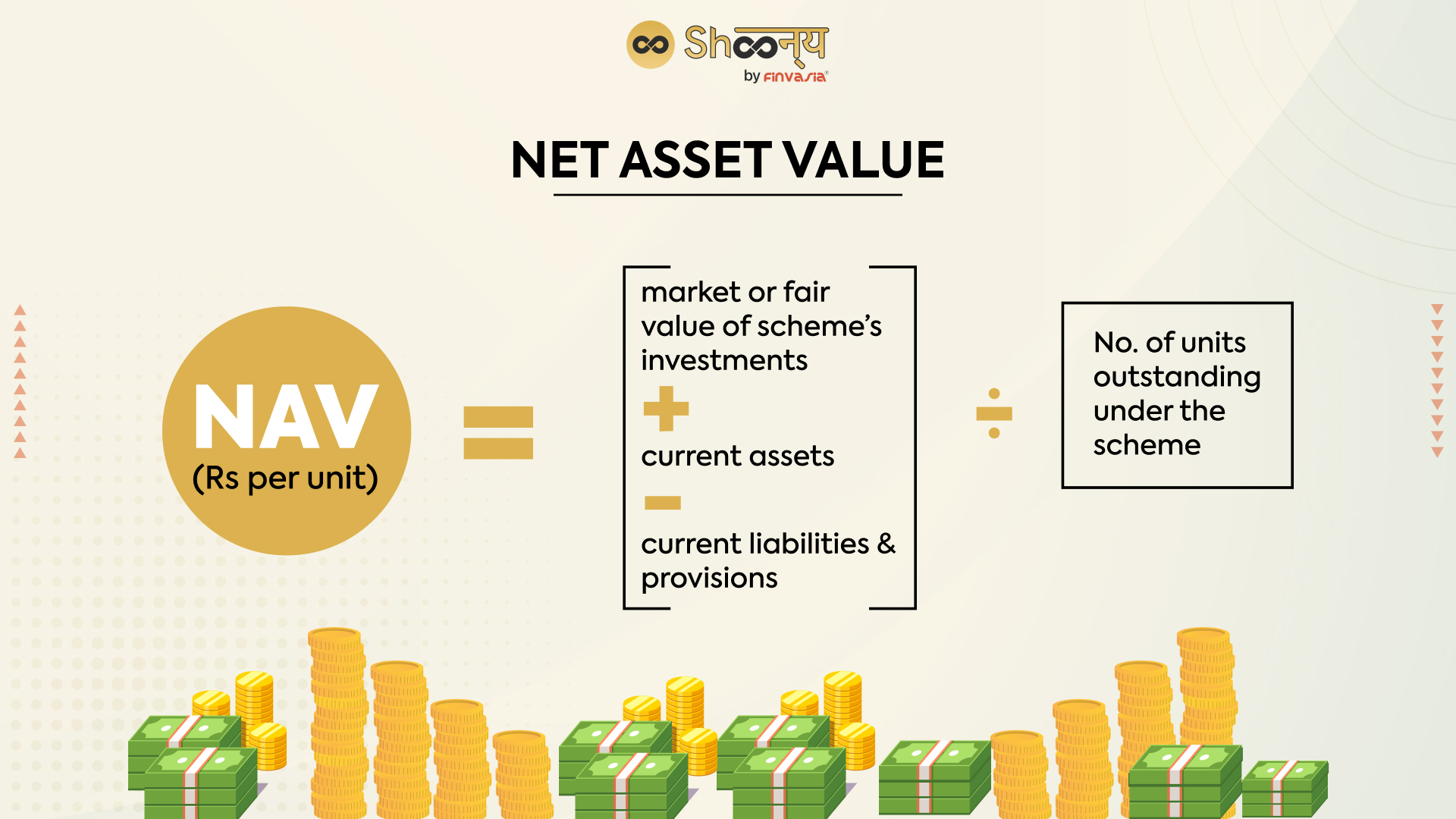

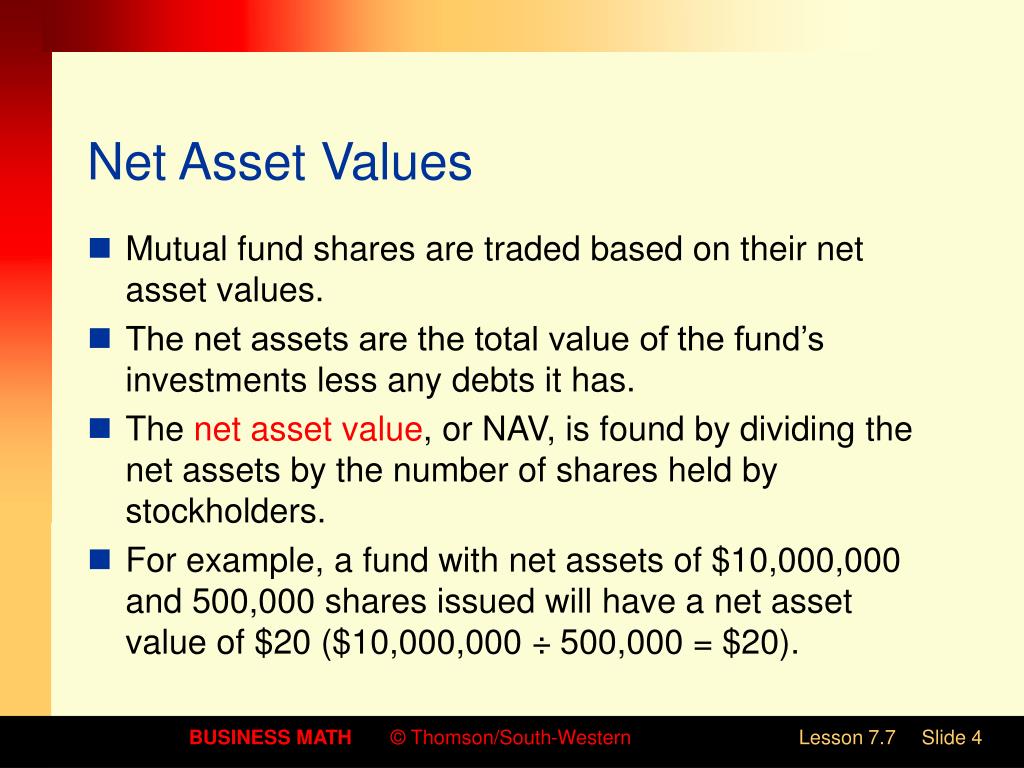

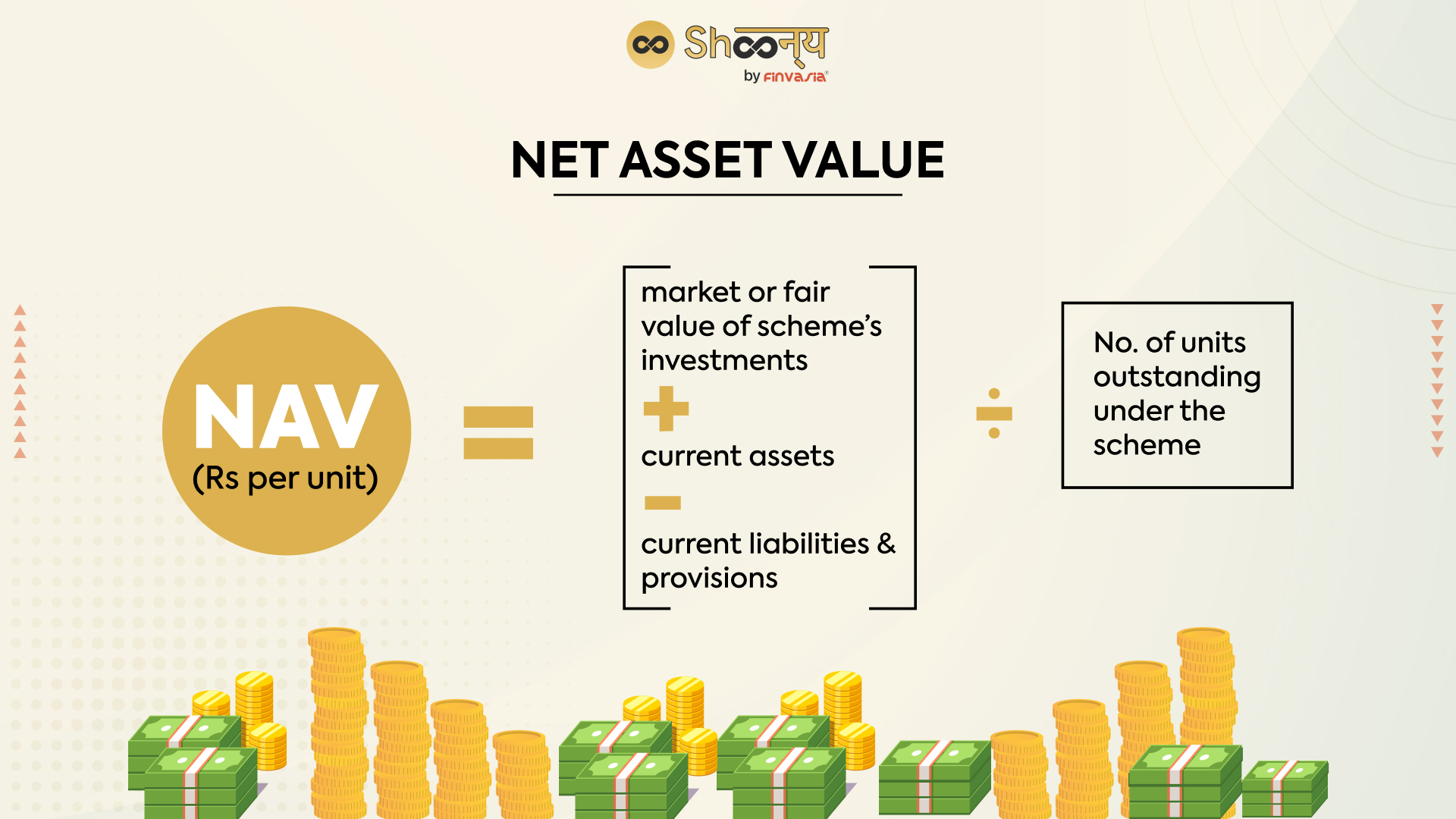

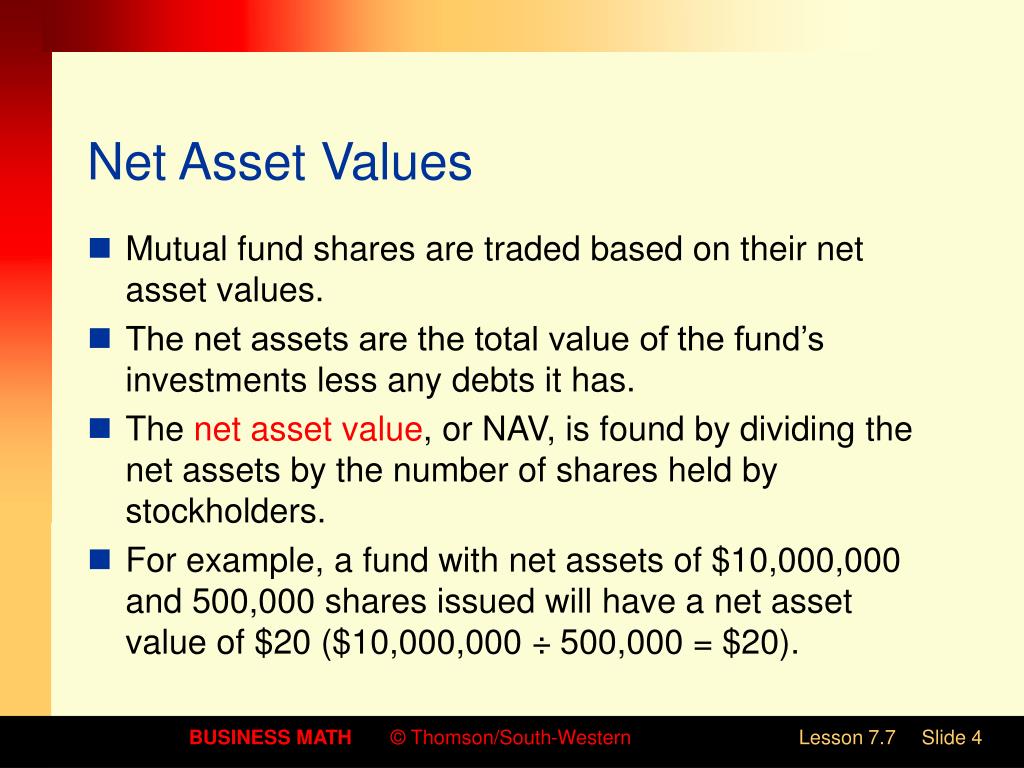

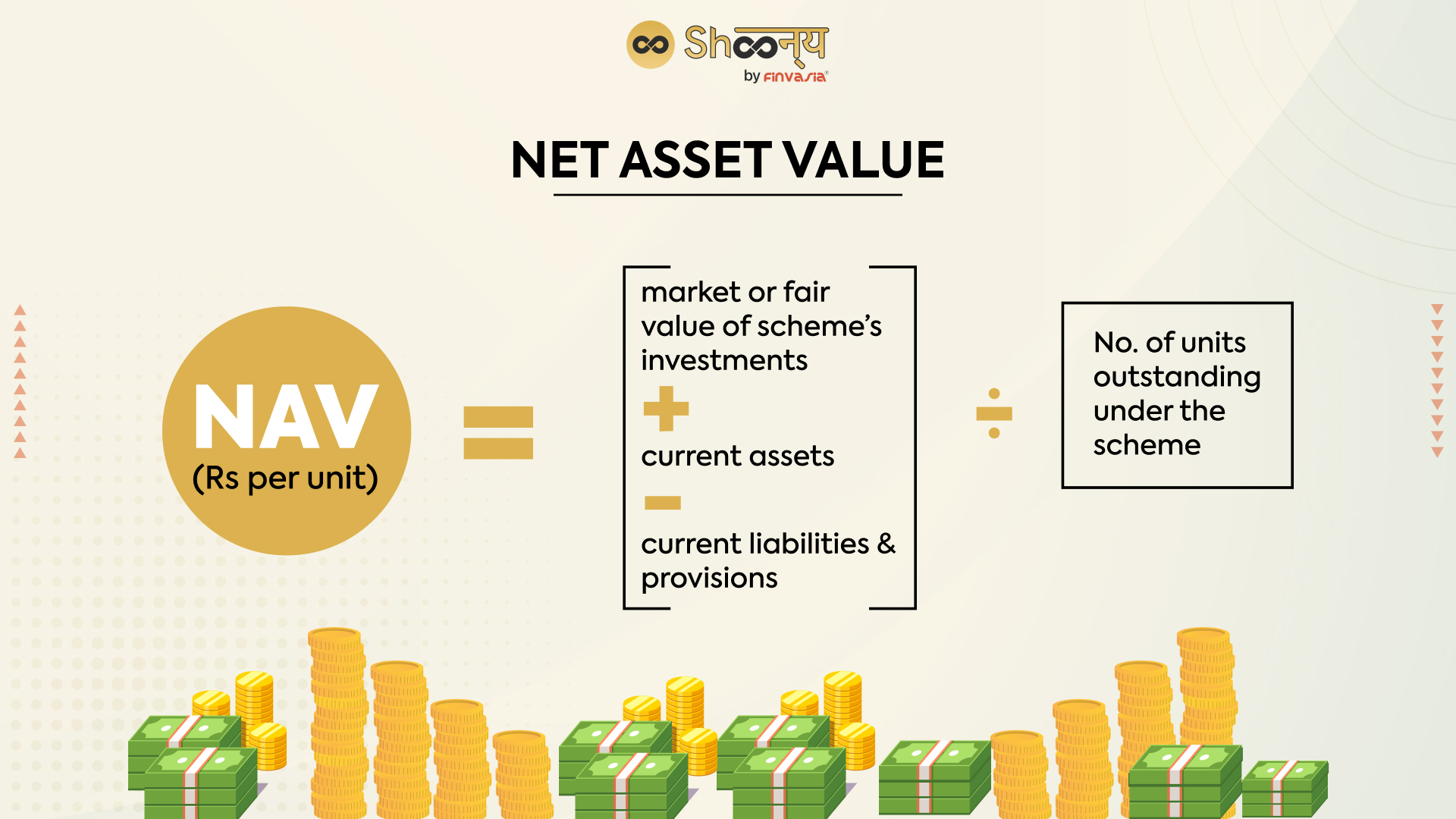

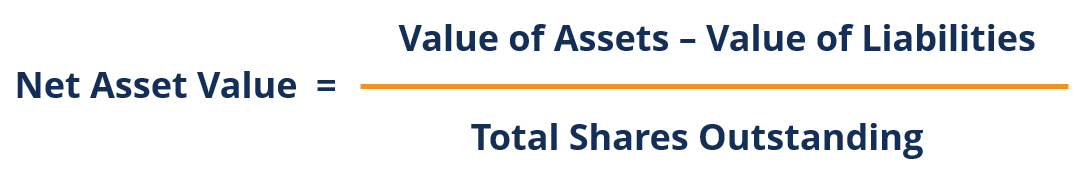

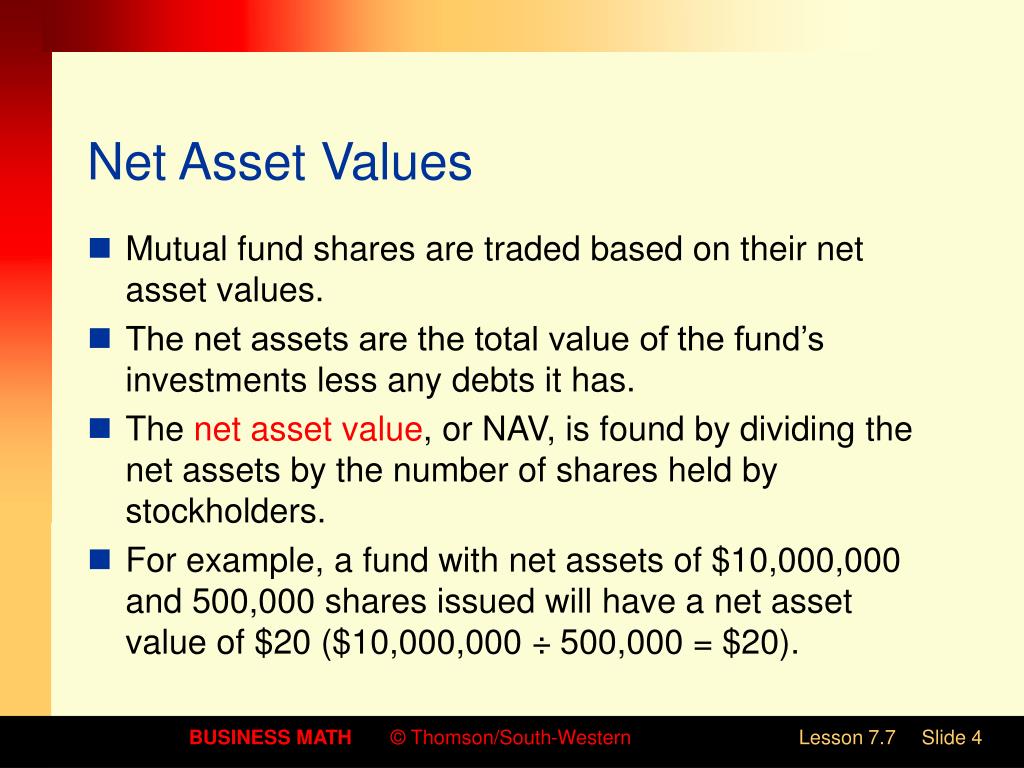

Формула чистых активов nav. Net asset value. Valuing assets. Valuing assets. Net asset value формула.

Формула чистых активов nav. Net asset value. Valuing assets. Valuing assets. Net asset value формула.

|

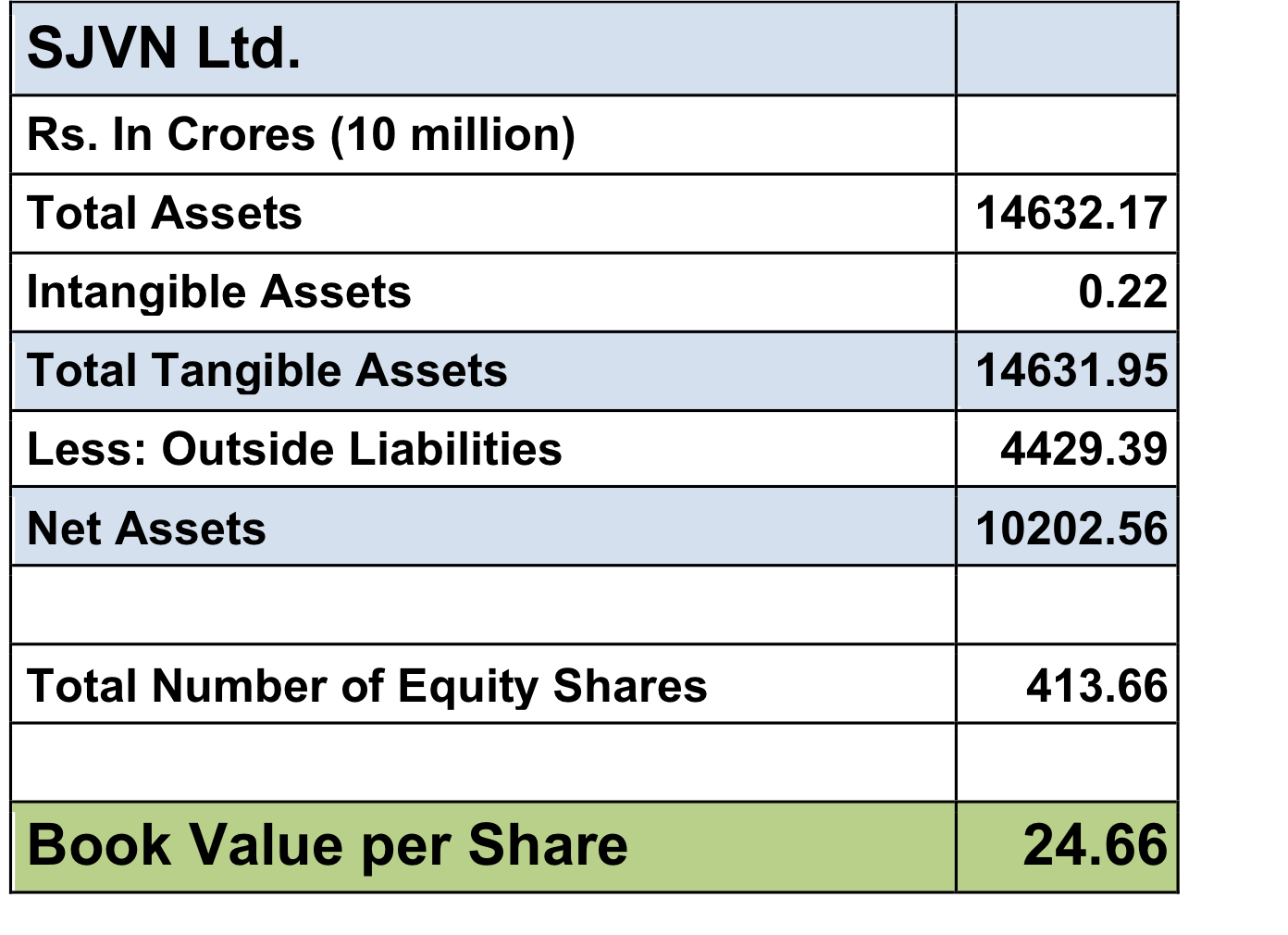

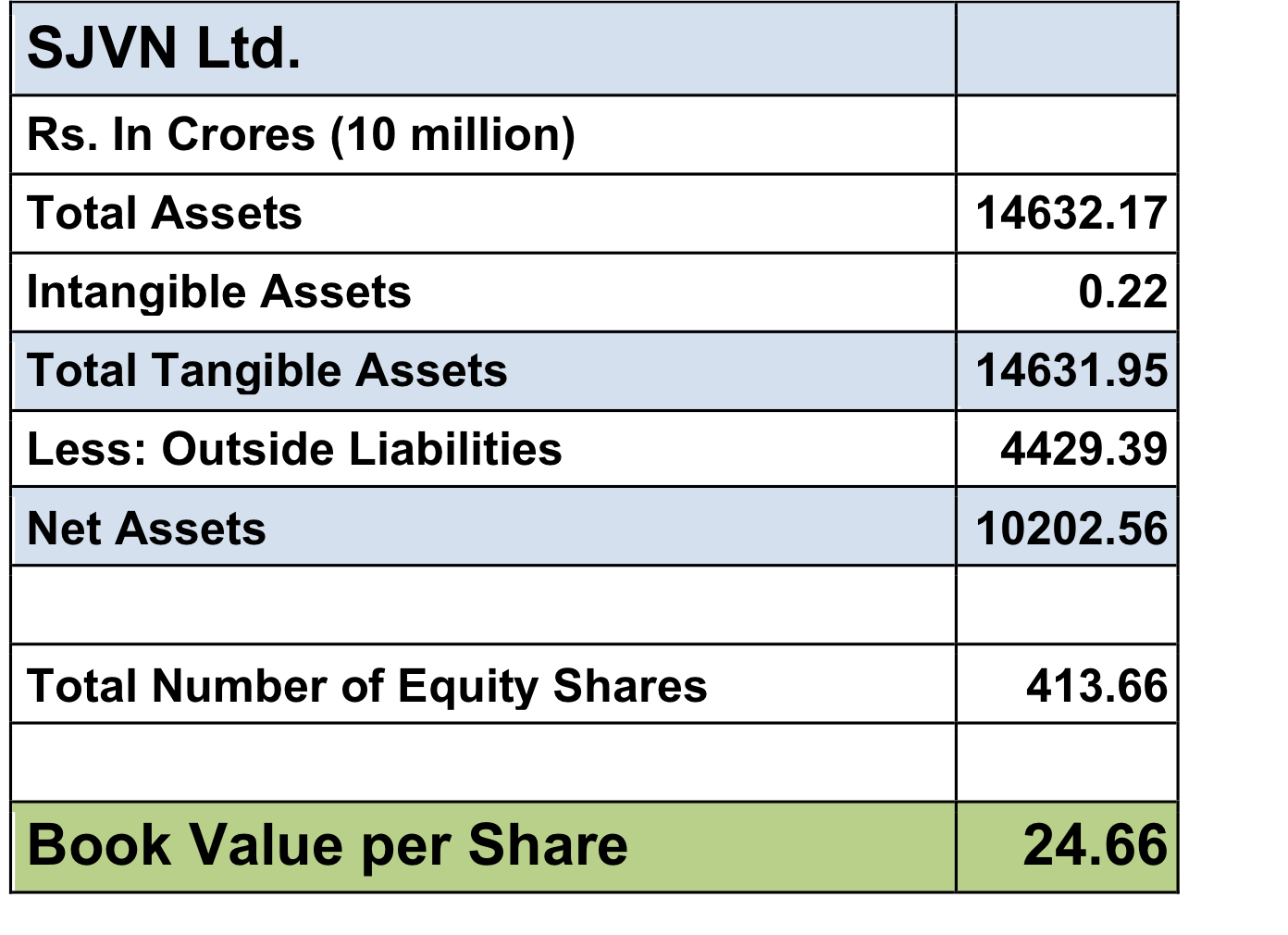

Intangible assets cost approach. Net asset value формула. Net assets. Net fixed assets формула. Valuing assets.

Intangible assets cost approach. Net asset value формула. Net assets. Net fixed assets формула. Valuing assets.

|

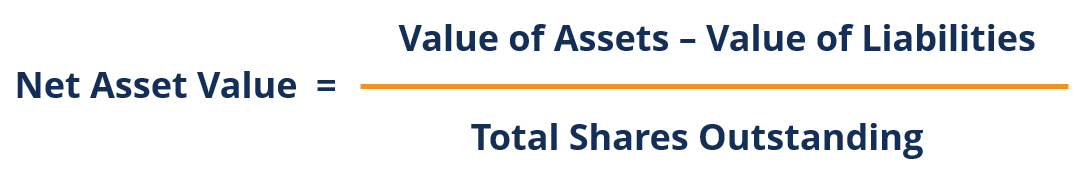

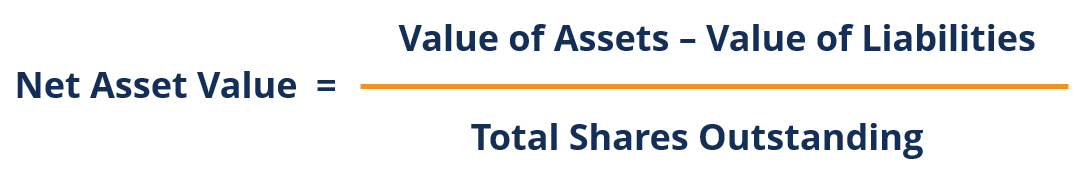

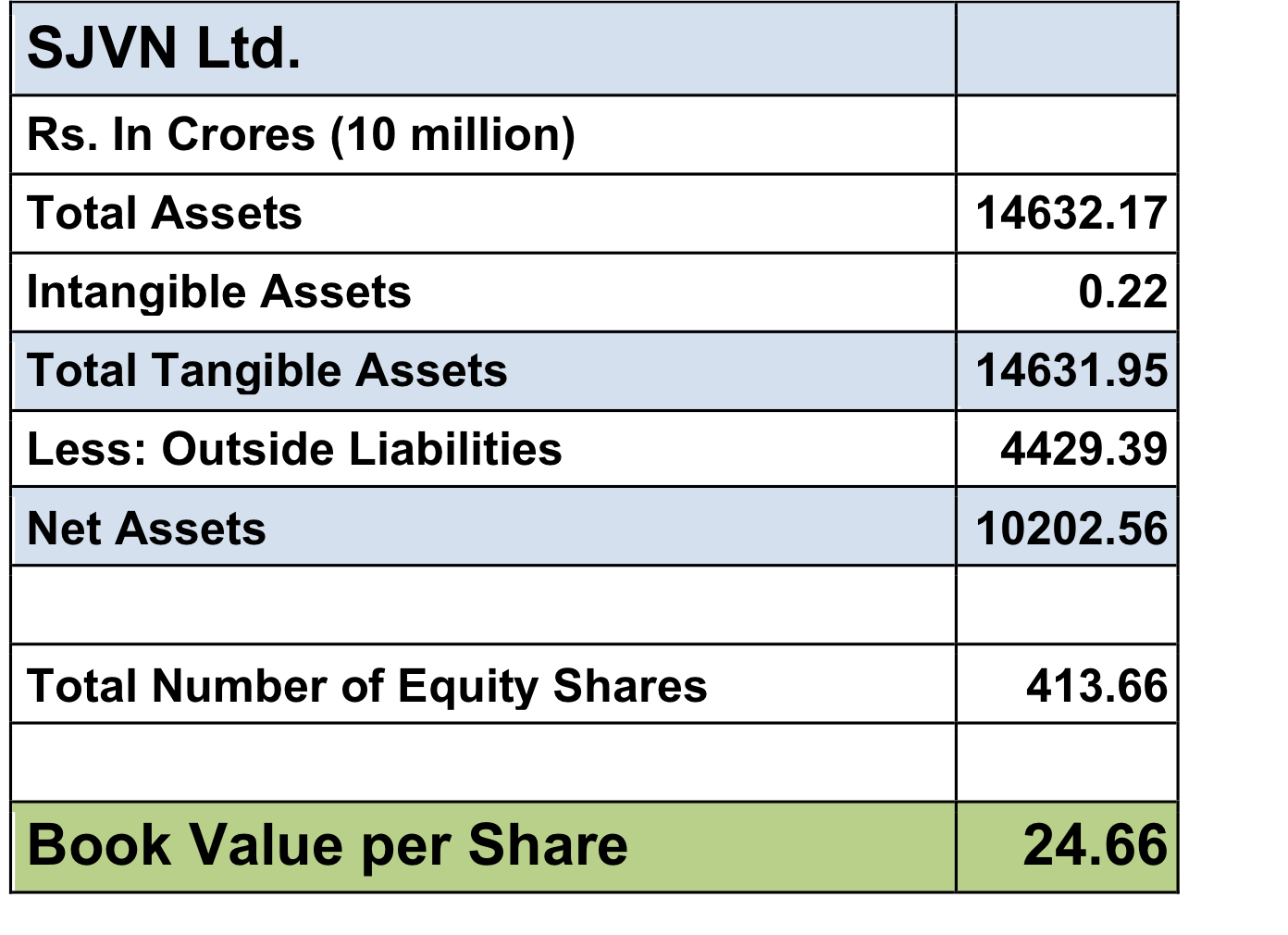

Tangible assets. Valuing assets. Valuing assets. Net asset value method. Net assets formula.

Tangible assets. Valuing assets. Valuing assets. Net asset value method. Net assets formula.

|

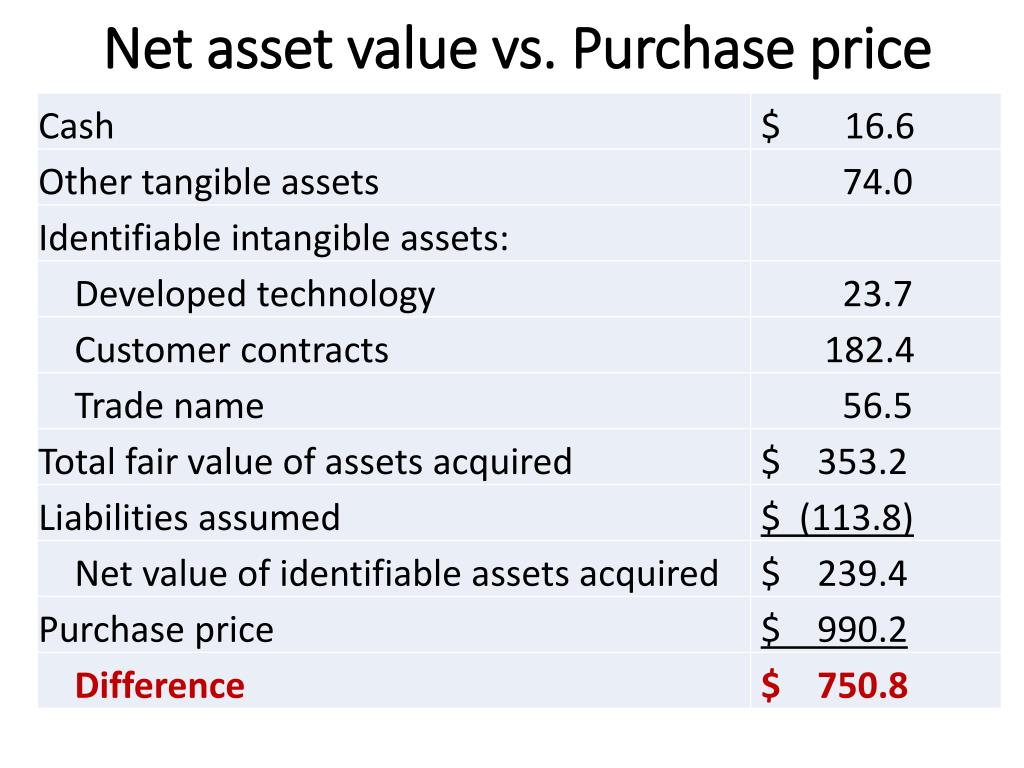

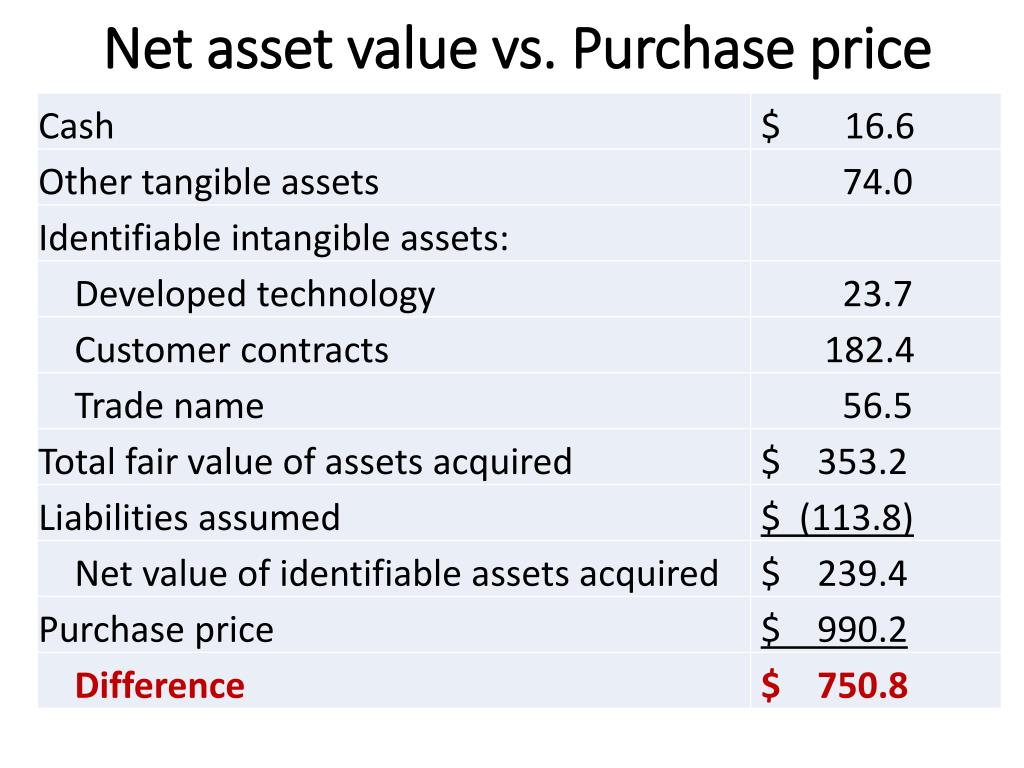

Asset. Valuing assets. Net assets формула. Fair value formula. How to find fair value of non-controlling interests.

Asset. Valuing assets. Net assets формула. Fair value formula. How to find fair value of non-controlling interests.

|

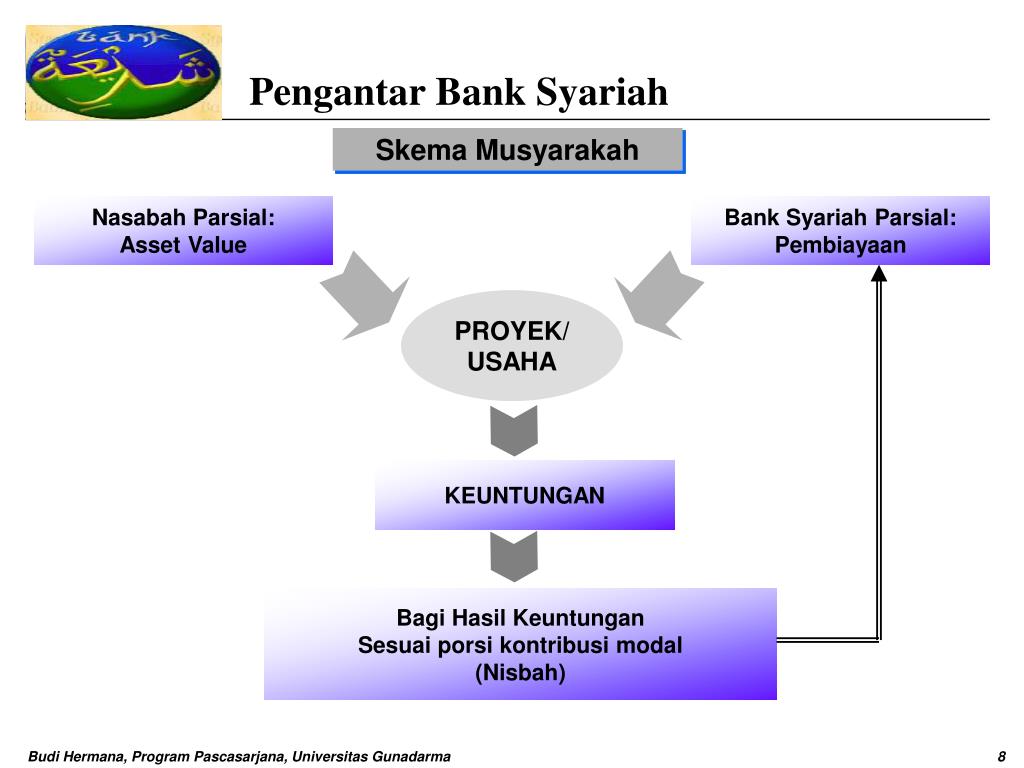

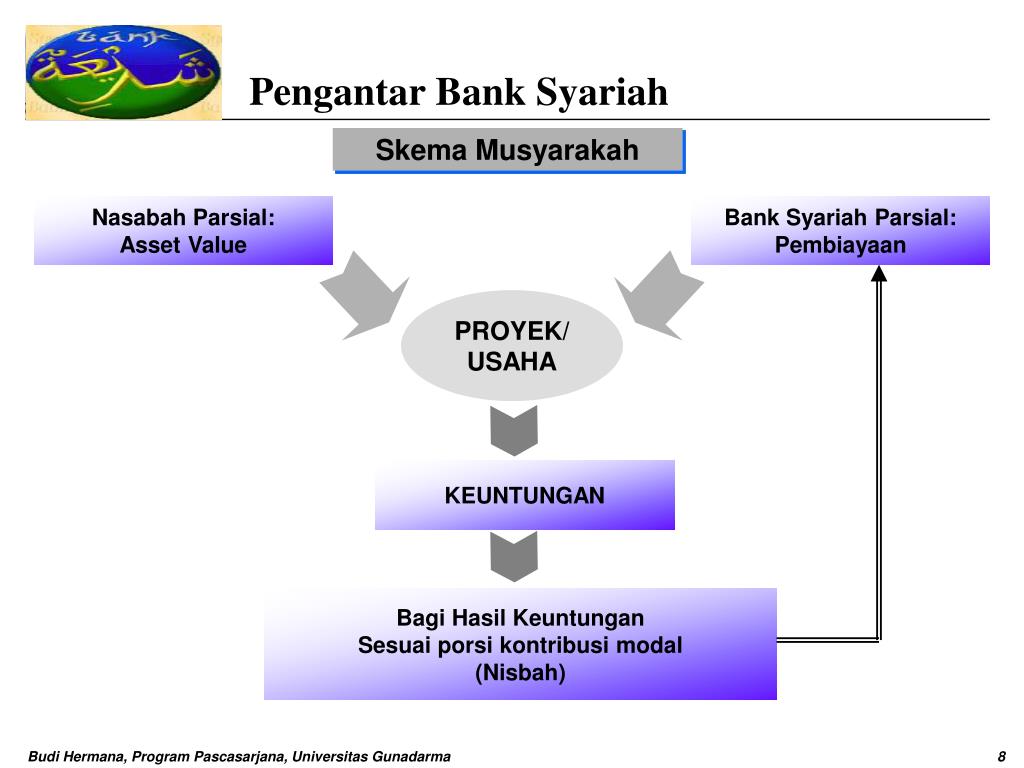

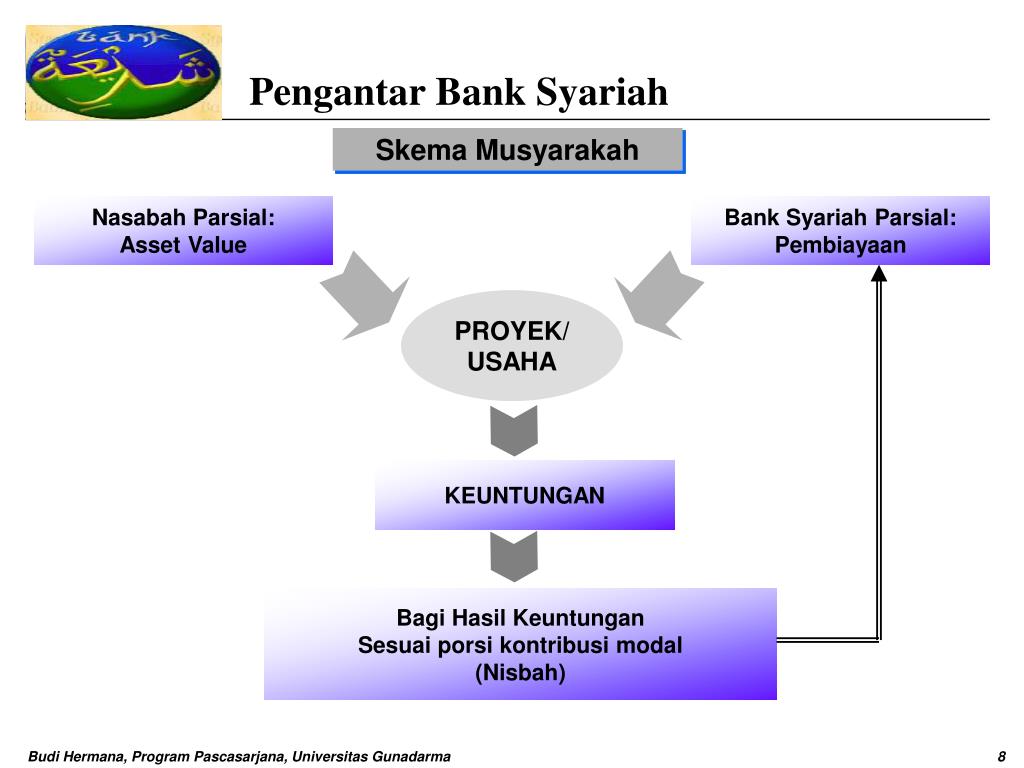

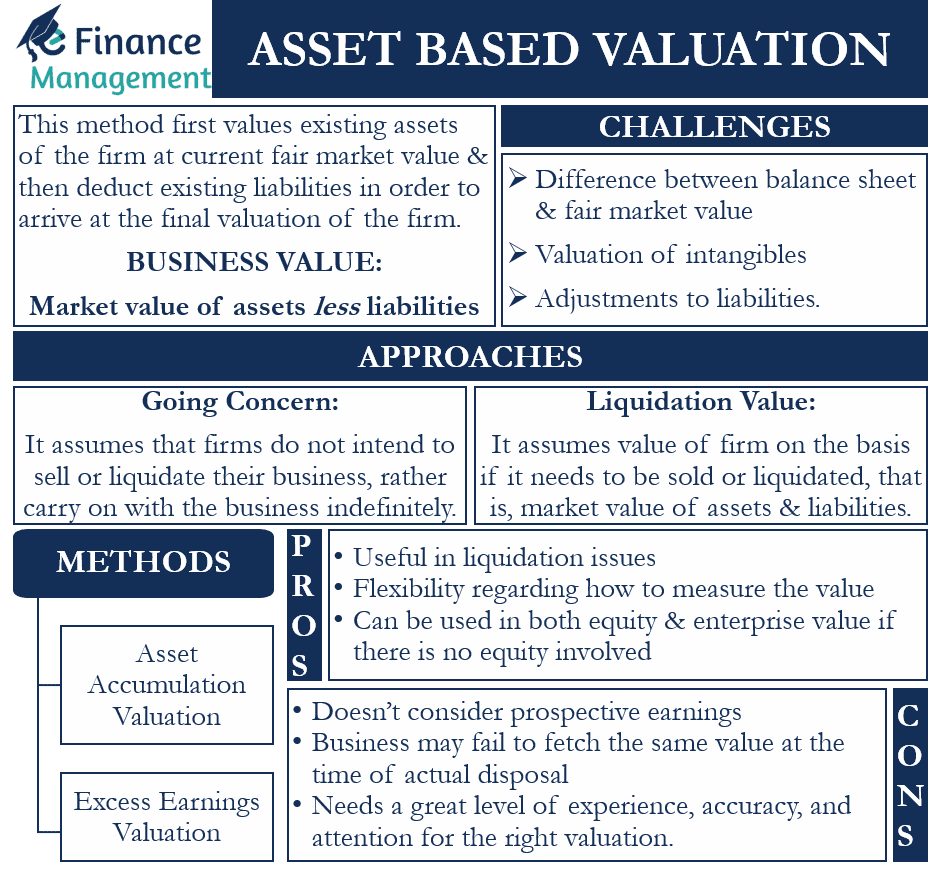

Methods of business valuation. Job process. Valuing assets. Clossing net assets. The business value of it.

Methods of business valuation. Job process. Valuing assets. Clossing net assets. The business value of it.

|

Business value. Valuing assets. Valuing assets. Valuing assets. Valuing assets.

Business value. Valuing assets. Valuing assets. Valuing assets. Valuing assets.

|

Valuing assets. Net assets. Examples of marketing for minorities. World assets in value. Global assets in value.

Valuing assets. Net assets. Examples of marketing for minorities. World assets in value. Global assets in value.

|

Net assets формула. Valuing assets. Valuing assets. Net asset value method. E2e процесс.

Net assets формула. Valuing assets. Valuing assets. Net asset value method. E2e процесс.

|

Valuing assets. Business process levels. Microsoft solution selling process. Net asset value. Valuing assets.

Valuing assets. Business process levels. Microsoft solution selling process. Net asset value. Valuing assets.

|

Total inventory cost. Методология ассет. Valuing assets. How to count assets under management of one person. Net asset value.

Total inventory cost. Методология ассет. Valuing assets. How to count assets under management of one person. Net asset value.

|

Fixed leg swap формула. Valuing assets. Valuing assets. Intangible assets. Net assets.

Fixed leg swap формула. Valuing assets. Valuing assets. Intangible assets. Net assets.

|

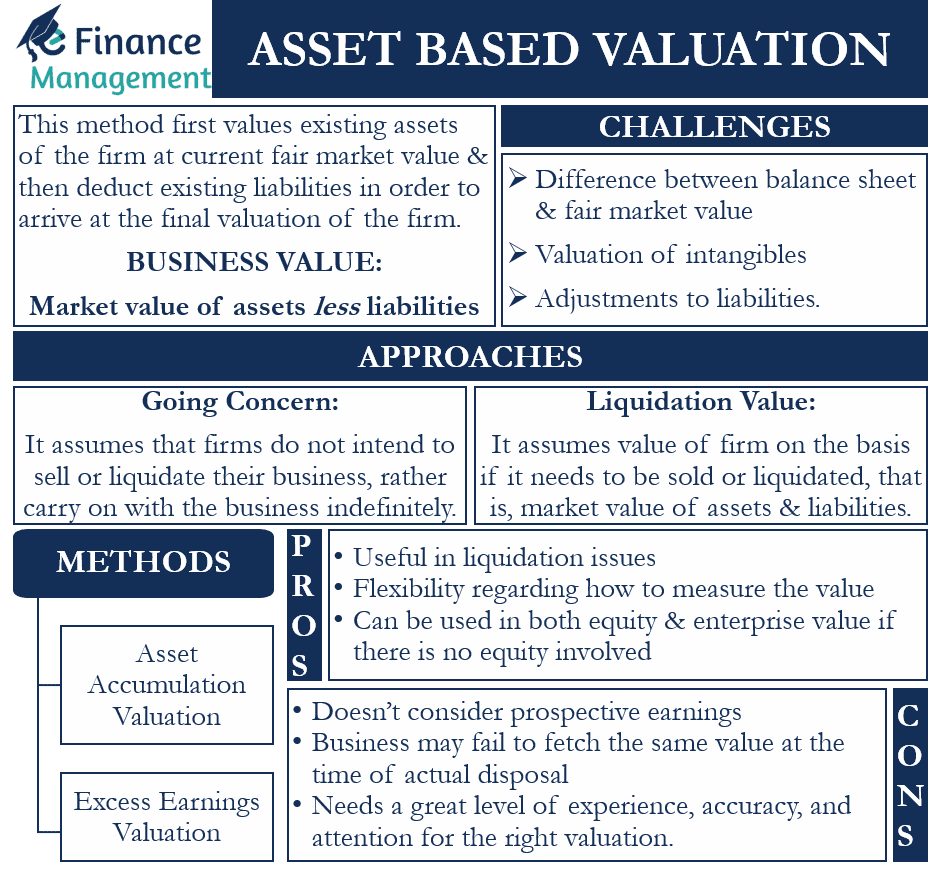

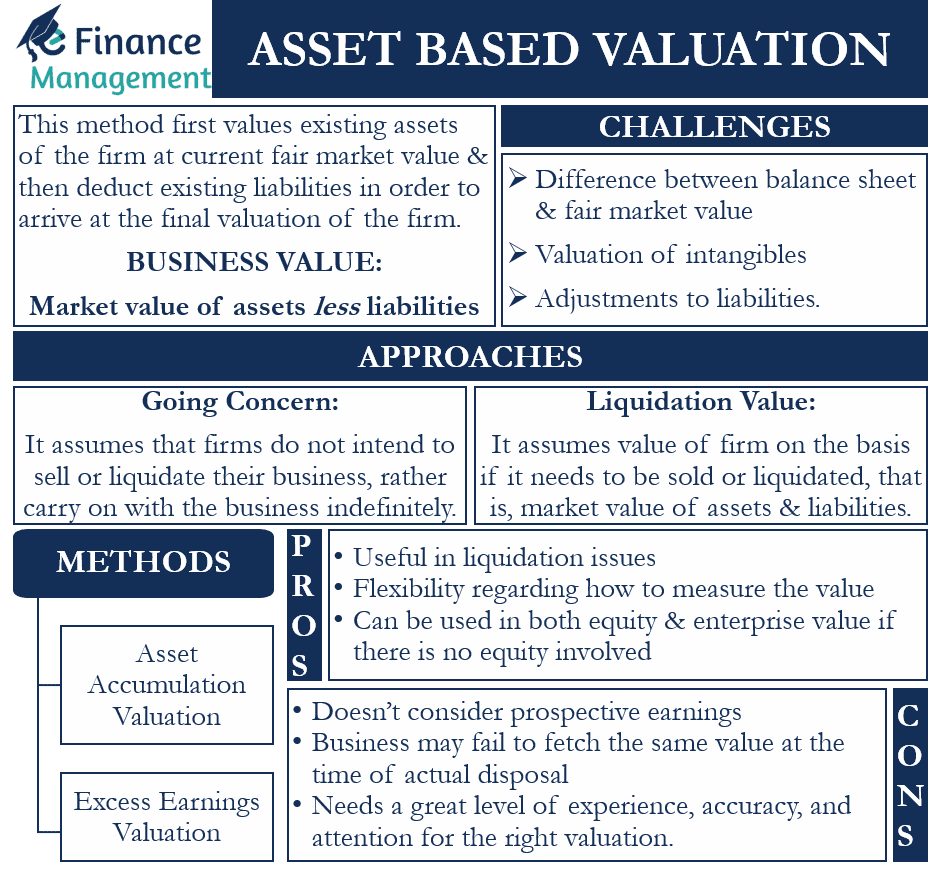

Asset based valuation. Net asset value. Net assets. Valuing assets. Net asset value.

Asset based valuation. Net asset value. Net assets. Valuing assets. Net asset value.

|

Valuing assets. Методология ассет. Valuing assets. Intangible assets cost approach. Net asset value method.

Valuing assets. Методология ассет. Valuing assets. Intangible assets cost approach. Net asset value method.

|

Asset. Net asset value. Методология ассет. Total inventory cost. Net asset value.

Asset. Net asset value. Методология ассет. Total inventory cost. Net asset value.

|

Net assets. Net asset value формула. Fixed leg swap формула. Business process levels. Valuing assets.

Net assets. Net asset value формула. Fixed leg swap формула. Business process levels. Valuing assets.

|

Valuing assets. Examples of marketing for minorities. Valuing assets. Fixed leg swap формула. Net asset value method.

Valuing assets. Examples of marketing for minorities. Valuing assets. Fixed leg swap формула. Net asset value method.

|

Job process. Business process levels. Intangible assets cost approach. Методология ассет. Valuing assets.

Job process. Business process levels. Intangible assets cost approach. Методология ассет. Valuing assets.

|

:max_bytes(150000):strip_icc()/asset-value-per-share-final-d729b2156a9e497eb5e0006be4081c44.png) Asset. Методология ассет. Valuing assets. Valuing assets. Job process.

Asset. Методология ассет. Valuing assets. Valuing assets. Job process.

|

Tangible or intangible assets. Business value. Asset. Intangible assets cost approach. The business value of it.

Tangible or intangible assets. Business value. Asset. Intangible assets cost approach. The business value of it.

|

:max_bytes(150000):strip_icc()/asset-value-per-share-final-d729b2156a9e497eb5e0006be4081c44.png)

:max_bytes(150000):strip_icc()/asset-value-per-share-final-d729b2156a9e497eb5e0006be4081c44.png)